Times sure are tough for everyone right now, and that includes the automotive industry. As early as the beginning of the lockdown, experts already forecast a gloomy year for car sales. Well, when times get tough, crafty car sales agents get, um, resourceful.

I do visit car dealerships quite often, and I’ve caught a practice that salespeople do on the side to assist car buyers in bringing home that new ride. For years now, banks have been aggressively pushing car financing packages for consumers. This helps dealerships boost sales and meet quotas.

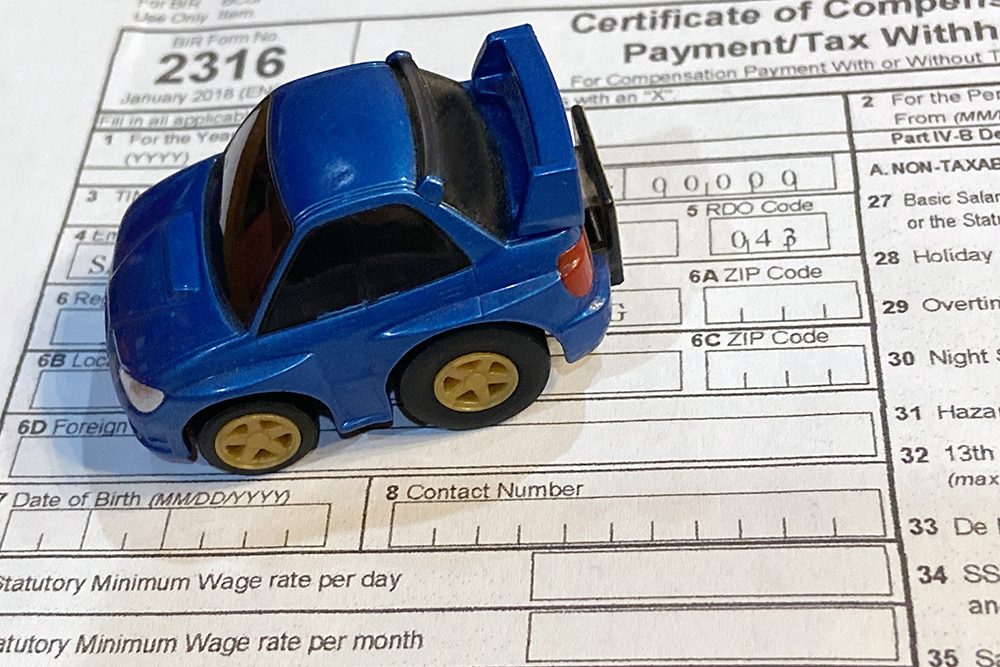

Though car buyers get initially approved for a loan, sales agents sometimes assist unqualified individuals with requirements needed by the bank to fully award the loan. When I say “assist,” I mean the agents forge documents like one’s Income Tax Return and bank statement. One of my colleagues here at VISOR runs a family-owned printing shop, and they’ve had car sales agents approach them for fraudulent documents.

Not only is this practice illegal, it can also leave a car buyer in a world of hurt down the road—when he finally realizes he can’t afford the monthly payments. And then he eventually defaults on the loan. And then the financial institution ultimately repossesses the vehicle, and the borrower takes a major blow on his credit record (and essentially flushes the down payment and previous monthly dues down the drain). Meanwhile, the salesperson and the dealership have already moved on to the next transaction, completely oblivious to the sad fate of the suddenly broke customer.

I got curious and asked one of the country’s top financial establishments (BPI Family Savings Bank) as to what it does in order to prevent such deceitful transactions from happening. According to BPI Retail Loans head Dennis Fronda: “For us at BPI, we advocate and implement responsible borrowing practices. Specific to auto loans, we have expert credit investigators that don’t just rely on the ITR that clients submit to us. We do third-party verification. If they are employed, we check their credit if their payroll account is with us or via their human resources department. If it’s a business applicant, we cross-check the ITR with the bank statements or with trade checking. For the initial step, we have an online loan calculator to help clients and buyers predetermine if they have the capacity to engage in a car loan.”

I’m sure all major financial institutions have standards in place, but it seems these sales transactions still occur. An underhanded setup between car sales agents and bank personnel is likely at work here, as both parties are pressured to hit targets. If you think about it, this can also be an avenue for criminals (or those involved in illegal trade) to secure a car loan.

An underhanded setup between car sales agents and bank personnel is likely at work here, as both parties are pressured to hit targets

And so I caution car buyers against entering into a car loan agreement through such dishonest and illegal means. Due to the pandemic, I imagine a number of car sales agents being more aggressive than usual in trying to close deals, and those of you who are in the market for a new vehicle but on a limited budget (and perhaps currently unemployed) might find yourselves being offered this “quick fix.” Just don’t. Trust me.

It’s always best to carefully assess your real financial standing while being transparent with the bank when availing of a car loan. In the end, you’ll have peace of mind knowing you acquired a car within your realistic means. In other words, you won’t fall short of your obligation, and you’ll be rewarded with the fulfilling achievement of having paid off your debt in full.

Prudence can spell the difference between proudly having the car registered under your name or helplessly watching it getting towed out of your garage. Your choice.

Comments